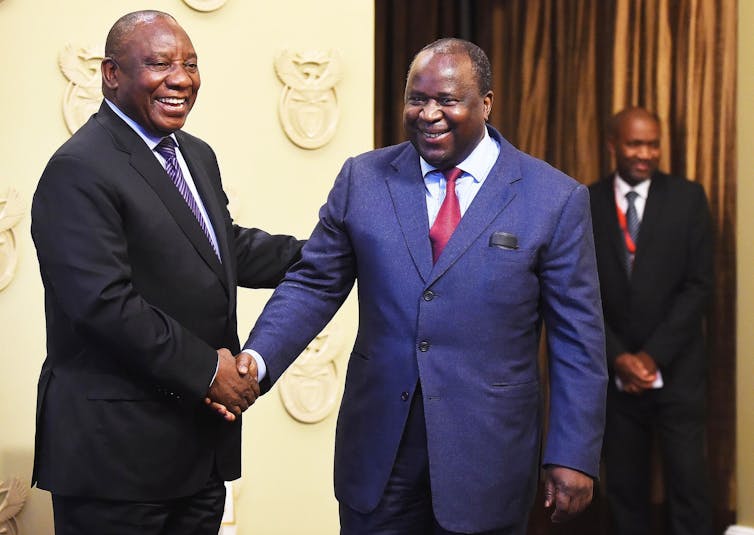

South Africa’s Finance Minister Tito Mboweni must walk a fiscal tightrope.

GovernmentZA/Flickr

South African finance minister Tito Mboweni’s 2018 medium-term budget policy statement brought no surprises. Standing before the National Assembly on Wednesday 24 October, Mboweni presented the Natural Treasury’s fiscal policy and projections for the next three years.

The country’s economic growth has been officially revised down to 0.7% – it was at 1.5% in the Budget tabled in February by one of Mboweni’s predecessors, Malusi Gigaba. Revenue collection is lower than had been forecast. This all means that national debt levels will, again, be higher than projected.

In short, there’s very little tangible good news. That is to be expected. The economy and public finances have been in a poor state for some time. The current level of economic growth is below estimates of population growth, meaning that South Africans will have become poorer per person by the end of the year.

But with debt levels having repeatedly exceeded the levels previous ministers of finance had promised, numerous risks on the horizon and an election looming, there was relatively little room for Mboweni to manoeuvre.

What Mboweni and National Treasury have tried to do is to keep walking an increasingly thin tight-rope. This involves containing the growth in debt while not reducing government expenditure or increasing taxation to the point where it greatly harms economic growth or South Africans’ well-being.

Unless economic growth improves, the country will have to step off this tightrope. Either debt must be increased well beyond what had been planned, possibly leading to downgrades, higher borrowing costs and the associated consequences. Or expenditure will be cut and more taxes imposed – leading to immediate negative effects for citizens.

Public finances

One way that Treasury is trying to stay on the tightrope is by making use of other borrowing and spending capacity in the state. In particular, it’s looking to government’s development finance institutions such as the Development Bank of Southern Africa, the Industrial Development Corporation and the Land Bank to use their borrowing and lending capacity.

The medium-term budget policy statement also argues that various municipalities have sufficiently reliable revenue streams to borrow and spend more than they currently do.

The Treasury has indicated in the policy statement that it hopes to keep tax rates at their current levels and not introduce new ones. One important exception will be at the forefront of many South Africans’ minds: increases to the cost of fuel, in this instance possible large increases in the Road Accident Fund levy, to address the massive accumulated liability in the Fund itself.

Last year the medium-term budget policy statement discussed risks to public finances, including possible further downgrades of debt by international rating agencies and the likely consequences. This year’s statement avoided such references – but some debt downgrades and their negative results remain a possibility.

Mboweni made it clear that one of the most serious risks to public finances is the perilous condition of state-owned enterprises. More than R9 billion is going to be given to South African Airways, SA Express and the Post Office in the current financial year to prop up their finances.

Beyond this, all he could do was express the hope that restructuring these and other state-owned entities means it could reduce the risk although he offered little detail about what “restructuring” actually means.

Even though he said that there should be “no holy cows”, it’s questionable whether structural shifts could really deal with the financial risks; in certain circumstances, restructuring could actually increase the state’s financial burden.

Reforming key state institutions in general is critical. But there will be little to show for that in the short term when it comes to public finances. In fact, in some instances, doing the right thing can lead to short-term costs.

Hints, but little detail

There were some suggestions in the statement of a sensible, “New Deal” way of thinking. These include the reallocation of existing funds to the Expanded Public Works Programme, clothing and textile industry support and faster-spending infrastructure programmes. But with such limited resources this is likely to only have a small positive effect.

And in parts, Mboweni provided too little or no detail. There remains inadequate information on the costs of providing “free higher education” as promised by former President Jacob Zuma to new entrants. This reflects the irresponsibility of committing to a blank cheque to university student funding at a time when public finances are under huge strain.

Politically, the cabinet will be hoping that local and global risks will be kept in check until the 2019 election. But if some of those materialise then the government could face the unenviable task of either presenting a very unpopular budget in February 2019, or allowing public finances to deteriorate to a concerning degree.

Seán Mfundza Muller, Senior Lecturer in Economics and Research Associate at the Public and Environmental Economics Research Centre (PEERC), University of Johannesburg

This article is republished from The Conversation under a Creative Commons license.