Under President Jacob Zuma the economy didn’t recover as much as it should have from the global financial crisis.

Shutterstock

South Africa’s public finances are in a perilous state. There are four main reasons for this. First, economic growth is low or non-existent. Second, tax revenue collection is repeatedly below forecasts. Third, debt levels have risen rapidly and are now at their highest levels in the post-apartheid era. Fourth, the poor performance of state-owned enterprises is necessitating large-scale government support.

Recent developments since the tabling of the 2019/20 Budget in February 2019 have only made the situation worse. A downgrade of government debt to ‘junk’ by a third ratings agency will lead to an outflow of investment and exacerbate matters further. South Africa is, in fact, fortunate that this has not already happened.

The state of South Africa’s public finances is the outcome of different dynamics in three, overlapping periods. The first was the period after the 2008 global financial crisis. The second was the period under the continued presidency of Jacob Zuma. And the third has been the period since Zuma was succeeded by Cyril Ramaphosa. Careful consideration of these periods contradict widely-circulated claims in the political space.

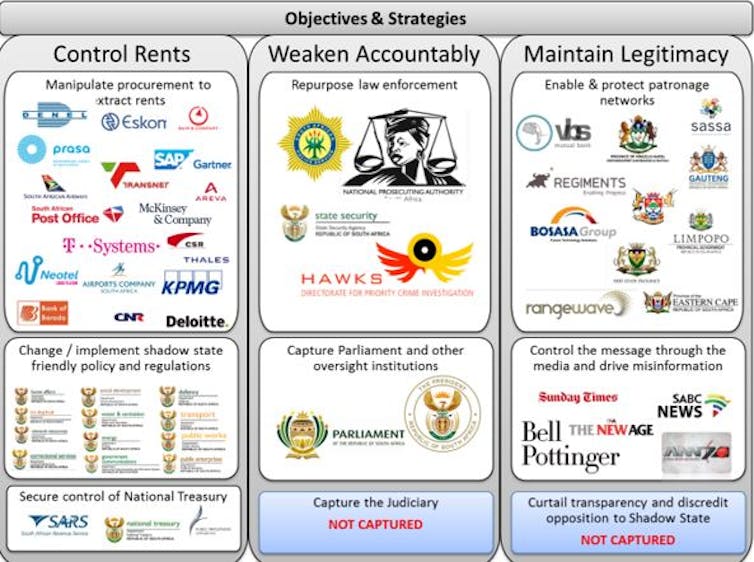

Some have claimed that South Africa’s woes began with Zuma but this is not true. The first shock to the economy under public finances was the global financial crisis. Others have claimed that Zuma is not responsible for poor economic and public finance performance, but this is also not true. South African economic performance should have been able to recover to a much greater degree than it did under the era of his leadership. Government revenue collection seems to have been negatively affected by institutional destabilisation of the South African Revenue Service.

Finally, the deterioration of economic indicators (growth and employment), along with further underperformance of revenue collection and public finances more broadly, is being laid at the door of Ramaphosa’s presidency. That is simply implausible.

The deterioration can often be linked to factors that preceded Ramaphosa’s replacement of Zuma in early 2018. Admittedly, Ramaphosa has not helped his case by making promises about job creation, for instance, that may be outside the ability of the state to deliver.

Understanding why such claims are likely to be wrong is important not just because of attributing blame, but in order to understand what the fundamental drivers are behind the country’s current state and future trajectory.

Recycled disagreements

Unfortunately, beyond blame, much of the policy discussion is characterised by recycled disagreements. These date to the era in which the African National Congress (ANC) government adopted the Growth, Employment and Redistribution (GEAR) strategy – which was opposed and resented by left-wing parts of the ANC alliance. That strategy was largely concerned with reducing the debt levels the new democratic government inherited from its apartheid predecessors.

For example, left-wing commentators have argued for expansionary fiscal policy. This basically means increasing government spending to a significant degree. They have also claimed that National Treasury implemented ‘austerity’ after 2008. This is incoherent. First, South Africa actually adopted a ‘countercyclical’ approach after 2008: government spending increased faster than revenue. That is how the country’s debt initially escalated.

Second, increasing government expenditure in the manner proposed is, at best, a very high risk strategy. With the country’s public finances already under strain, an increase in expenditure that does not deliver significant increases in economic growth and tax collection will lead to a dramatic deterioration in public finances. That could cause harm for generations to come. These risks, which seem more likely than the benefits, are never mentioned by populists who simply regurgitate arguments from earlier eras.

The reality is that even though Treasury attempted to maintain government spending to support the economy during the aftermath of the global financial crisis, and then attempted to stabilise debt levels using a policy of ‘fiscal consolidation’, it has been unable to do either. The economy has not recovered, arguably due in significant part to the ravages of state capture and other state failures in the Zuma era. Debt targets have been regularly missed. At one point national government debt was expected to stabilised below 45% of GDP, now it has gone above 60% and may reach 70% of GDP within a few years.

There is no consensus among economists or other public finance experts on a specific threshold that is tolerable. What is clear though is that the higher the amount of debt relative to the size of the economy, the greater the risk. This is especially true where economic growth is lacklustre, as it has been in South Africa for some years.

Recent developments have only made the situation more dire. In the 2019 Budget, Treasury indicated that it would have to breach its expenditure ceiling for the first time in order to give support to national power utility Eskom amounting to R23 billion per year for an intended 10 years. That was despite planned cuts to public service employment and additional tax measures.

Since then, Eskom was given a lower-than expected tariff increase by the National Energy Regulator (NERSA). National government has also tabled an additional proposal to give Eskom a further R59 billion over two years.

It seems unlikely that government will be able to cut such vast sums in other parts of the state, not least at such short notice, with the result that debt targets will be exceeded again. And despite the money being poured into Eskom, there is no clear indication of the overall plan to stabilise the utility’s finances.

Meanwhile various other risks, like South African Airways, the Road Accident Fund and medical negligence lawsuits, continue to linger in the background. Economic growth and job creation are virtually non-existent, and both are below population growth. This means a higher unemployment rate and less national wealth per person.

In the face of the crisis with Eskom, public finances and economic growth, the only way to proceed is to secure a societal agreement on the way forward that recognises the need for sacrifices in the face of the crisis. Ramaphosa is uniquely equipped to secure a ‘social compact’ of this kind. But he is moving too slowly. This may be due in part to incessant factional battles in the ANC and an unprecedented assault on Ramaphosa and close allies like Public Enterprises Minister Pravin Gordhan that is being conducted through the Office of the Public Protector.

The president is also heavily reliant on advisers, his Cabinet and senior government officials – few of whom have shown that they can deliver on such a weighty responsibility. But as others have noted: if the country fails to agree in time, decisions will be forced upon it. And under such dire circumstances there will be less opportunity to protect vulnerable citizens with the least to sacrifice.

Seán Mfundza Muller, Senior Lecturer in Economics and Research Associate at the Public and Environmental Economics Research Centre (PEERC), University of Johannesburg

This article is republished from The Conversation under a Creative Commons license.